Milton Friedman

Appearance

(Redirected from Friedman, Milton)

Milton Friedman (31 July 1912 – 16 November 2006) was an American economist noted for his support for free markets and a reduction in the size of government. In 1976 he was awarded a Nobel Prize in Economics.

Quotes

[edit]

- A largely parallel example involving human behavior has been used elsewhere by Savage and me. Consider the problem of predicting the shots made by an expert billiard player. It seems not at all unreasonable that excellent predictions would be yielded by the hypothesis that the billiard player made his shots as if he knew the complicated mathematical formulas that would give the optimum directions of travel, could estimate accurately by eye the angles, etc., describing the location of the balls, could make lightning calculations from the formulas, and could then make the balls travel in the direction indicated by the formulas. Our confidence in this hypothesis is not based on the belief that billiard players, even expert ones, can or do go through the process described; it derives rather from the belief that, unless in some way or other they were capable of reaching essentially the same result, they would not in fact be expert billiard players.

It is only a short step from these examples to the economic hypothesis that under a wide range of circumstances individual firms behave as if they were seeking rationally to maximize their expected returns (generally if misleadingly called "profits") and had full knowledge of the data needed to succeed in this attempt; as if, that is, they knew the relevant cost and demand functions, calculated marginal cost and marginal revenue from all actions open to them, and pushed each line of action to the point at which the relevant marginal cost and marginal revenue were equal. Now, of course, businessmen do not actually and literally solve the system of simultaneous equations in terms of which the mathematical economist finds it convenient to express this hypothesis, any more than leaves or billiard players explicitly go through complicated mathematical calculations or falling bodies decide to create a vacuum. The billiard player, if asked how he decides where to hit the ball, may say that he "just figures it out" but then also rubs a rabbit's foot just to make sure; and the businessman may well say that he prices at average cost, with of course some minor deviations when the market makes it necessary. The one statement is about as helpful as the other, and neither is a relevant test of the associated hypothesis.- "The Methodology of Positive Economics" (1953)

- If we are to use effectively these abstract models and this descriptive material, we must have a comparable exploration of the criteria for determining what abstract model it is best to use for particular kinds of problems, what entities in the abstract model are to be identified with what observable entities, and what features of the problem or of the circumstances have the greatest effect on the accuracy of the predictions yielded by a particular model or theory.

- "The Methodology of Positive Economics" (1953)

- The construction of hypotheses is a creative act of inspiration, intuition, invention; its essence is the vision of something new in familiar material. The process must be discussed in psychological, not logical, categories; studied in autobiographies and biographies, not treatises on scientific method; and promoted by maxim and example, not syllogism or theorem.

- "The Methodology of Positive Economics" (1953)

- Over the period covered by these data, a drastic change has occurred in the responsibilities undertaken by the state to provide assistance to the aged, unemployed and otherwise dependent. This change has had divergent results on the particular data under discussion. The availability of assistance from the state would clearly tend to reduce the need for private reserves and so to reduce private saving—it is equivalent, in terms of our hypothesis, to a reduction in the variance of transitory components.

- A Theory of the Consumption Function (1957)

- I have no right to coerce someone else, because I cannot be sure that I'm right and he is wrong.

- "Say 'No' to Intolerance", Liberty magazine, vol. 4, no. 6, (July 1991) pp. 17-20.

- Now, when anybody starts talking about this [an all-volunteer force] he immediately shifts language. My army is 'volunteer,' your army is 'professional,' and the enemy's army is 'mercenary.' All these three words mean exactly the same thing. I am a volunteer professor, I am a mercenary professor, and I am a professional professor. And all you people around here are mercenary professional people. And I trust you realize that. It's always a puzzle to me why people should think that the term 'mercenary' somehow has a negative connotation. I remind you of that wonderful quotation of Adam Smith when he said, 'You do not owe your daily bread to the benevolence of the baker, but to his proper regard for his own interest.' And this is much more broadly based. In fact, I think mercenary motives are among the least unattractive that we have.

- The Draft: A Handbook of Facts and Alternatives, Sol Tax, edit., chapter: “Recruitment of Military Manpower Solely by Voluntary Means,” chairman: Aristide Zolberg, University of Chicago Press (1967) p. 366, based on the Conference Held at the University of Chicago, December 4-7, 1966, also in Two Lucky People, Milton and Rose Friedman, Chicago: University of Chicago Press, 1998, p. 380.

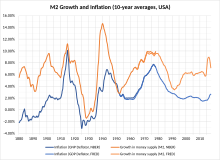

- Inflation is always and everywhere a monetary phenomenon in the sense that it is and can be produced only by a more rapid increase in the quantity of money than in output. … A steady rate of monetary growth at a moderate level can provide a framework under which a country can have little inflation and much growth. It will not produce perfect stability; it will not produce heaven on earth; but it can make an important contribution to a stable economic society.

- The Counter-Revolution in Monetary Theory (1970)

- Make politics an avocation, not a vocation.

- As quoted in “Milton Friedman: A Tribute”, David R. Henderson, antiwar.com, (Nov. 20, 2006), told to Henderson (May, 1970)

- There was nothing in these views to repel a student; or to make Keynes attractive. Keynes had nothing to offer those of us who had sat at the feet of Simons, Mints, Knight, and Viner.

- Milton Friedman, "Comments on the Critics", Journal of Political Economy, Vol. 80, No. 5 (Sep. - Oct., 1972)

- So the question is, do corporate executives, provided they stay within the law, have responsibilities in their business activities other than to make as much money for their stockholders as possible? And my answer to that is, no they do not.

- Interview "Milton Friedman Responds" in Chemtech (February 1974) p. 72.

- The problem in this world is to avoid concentration of power - we must have a dispersion of power.

- Inflation is the one form of taxation that can be imposed without legislation.

- Adapted from "Monetary Correction: A Proposal for Escalator Clauses to Reduce the Costs of Ending Inflation" (July 1974), see also AEI round table, July 1974.

- They had cliche answers but only to their self-created straw-men. To exaggerate only slightly, they had never talked to anyone who really believed, and had thought deeply about, views drastically different from their own. As a result, when they heard real arguments instead of caricatures, they had no answers, only amazement that such views could be expressed by someone who had the external characteristics of being a member of the intellectual community, and that such views could be defended with apparent cogency. Never have I been more impressed with the advice I once received: "You cannot be sure that you are right unless you understand the arguments against your views better than your opponents do."

- “Schools at Chicago3.” University of Chicago Record, 1974

- I think the government solution to a problem is usually as bad as the problem and very often makes the problem worse.

- An Economist's Protest (1975), p. 6; often quoted as "The government solution to a problem is usually as bad as the problem."

- I want people to take thought about their condition and to recognize that the maintenance of a free society is a very difficult and complicated thing and it requires a self-denying ordinance of the most extreme kind. It requires a willingness to put up with temporary evils on the basis of the subtle and sophisticated understanding that if you step in to do something about them you not only may make them worse, you will spread your tentacles and get bad results elsewhere.

- Interview with Richard Heffner on The Open Mind (7 December 1975)

- I say thank God for government waste. If government is doing bad things, it's only the waste that prevents the harm from being greater.

- Interview with Richard Heffner on The Open Mind (7 December 1975)

- If we have system in which government is in a position to give large favor - it's human nature to try to get this favor - whether those people are large enterprises, or whether they're small businesses like farmers, or whether they're representatives of any other special group. The only way to prevent that is to force them to engage in competition one with the other.

- One of the great mistakes is to judge policies and programs by their intentions rather than their results.

- Interview with Richard Heffner on The Open Mind (7 December 1975)

- In this day and age, we need to revise the old saying to read, "Hell hath no fury like a bureaucrat scorned."

- "Bureaucracy Scorned" in Newsweek (29 December 1975), later published in Bright Promises, Dismal Performance : An Economist's Protest (1983)

- The elementary truth is that the Great Depression was produced by government mismanagement. It was not produced by the failure of private enterprise, it was produced by the failure of government to perform a function which had been assigned to it.

- "Economic Myths and Public Opinion” The Alternative: An American Spectator vol. 9, no. 4, (January 1976) pp. 5-9, Reprinted in Bright Promises, Dismal Performance: An Economist’s Protest, New York: Harcourt Brace Jovanovich (1983) pp. 60-75

- This leads to my next myth—the myth that government can spend money at nobody’s expense. What was really involved in that last story was that somehow the local people do not pay out the money coming down from Washington somebody else does. Of course, the truth is that the money makes a round trip between Florida and Washington, and there is a discount taken off for cash as it passes through Washington. Some of you may remember that wonderful description of government by the French economist, Frederic Bastiat, who said that government is that fiction whereby everybody believes that he can live at the expense of everybody else.

- “Economic Myths and Public Opinion”, The Alternative: An American Spectator, vol. 9, no. 4, (January 1976) pp. 5-9

- That is a widespread myth, that it is possible to spend money with nobody paying for it. You have everybody screaming that we ought to have new, bigger, more generous government programs. Where are we going to raise the money? Tax business. But business corporations can’t pay any taxes. A corporate executive may sign the check, but where does he get the money? From his stockholders or from his customers or from his employees. Unlike the federal government, he doesn’t have a printing press in his basement. So the only way he can pay money to the government is imposing a burden on somebody. Government cannot spend money at nobody’s expense.

- “Economic Myths and Public Opinion”, The Alternative: An American Spectator, vol. 9, no. 4, (January 1976) pp. 5-9

- It's nice to elect the right people, but that isn't the way you solve things. The way you solve things is by making it politically profitable for the wrong people to do the right things.

- About changing congress (c. 1977)

- The great enemy of human freedom is the Government. By taking money out of our pockets and spending it, it destroys our freedom.

- The National Times, Australia, (March 1, 1977)

- The reality is that if you look at every program that the government has adopted in the direction of extending its scope, it took an enormous propaganda campaign by special propaganda groups to get those measures passed. There was no underlining public demand for those measures. On the contrary, the demand had to be created, it had to be developed, it had to be produced. And it was created, it was developed, it was produced, by people… who sincerely wanted to see an expansion in the scope of government.

- Let me take the example which is today the greatest sacred cow of them all—Social Security. Was there an overwhelming demand for Social Security in the 1930s when the law was adopted? Far from it. There was no public demand for it, it had to be sold. How was it sold? By the slickest devices of Madison Avenue, by imaginative packaging and deceptive labeling. Social Security was sold as an insurance scheme. It is not an insurance scheme. There is very little relationship to the amount of money any one individual pays and the amount of money he is entitled to receive. Social Security is a combination of a bad tax system with a bad way of distributing welfare… If you look at the tax system, who could defend a wage tax, a tax on wages up to a maximum, a tax on work, a tax which discourages employers from hiring people, and discourages people from going to work; a tax which is borne by the lowest wage group, workers? It is a regressive tax. You could never in a million Sundays… have gotten such a tax passed as a tax.

- Keep your eye on one thing and one thing only: how much government is spending, because that is the true tax. Every budget is balanced. There is no such thing as an unbalanced federal budget. You're paying for it. If you're not paying for it in the form of explicit taxes, you're paying for it indirectly in the form of inflation or in the form of borrowing. The thing that you keep your eye on is what government spends. And the real problem is to hold down government spending as a fraction of our income. And if you do that, you can stop worrying about the deficit.

- In my opinion, a society that aims for equality before liberty will end up with neither equality nor liberty. A society that aims first for liberty will not end up with equality, but it will end up with a closer approach to equality than any other kind of system that has ever been developed.

- You can only aim at equality by giving some people the right to take things from others. And what ultimately happens when you aim for equality is that A and B decide what C should do for D, except that they take a bit of commission off on the way.”

- [A] society which is socialist cannot also be democratic, in the sense of guaranteeing individual freedom.

- As quoted in "Capitalism, Socialism, and Democracy: A Symposium" (1 April 1978), edited by William Barrett, Commentary

- There's a sense in which all taxes are antagonistic to free enterprise … and yet we need taxes. We have to recognize that we must not hope for a Utopia that is unattainable. I would like to see a great deal less government activity than we have now, but I do not believe that we can have a situation in which we don't need government at all. We do need to provide for certain essential government functions — the national defense function, the police function, preserving law and order, maintaining a judiciary. So the question is, which are the least bad taxes? In my opinion the least bad tax is the property tax on the unimproved value of land, the Henry George argument of many, many years ago.

- As quoted in The Times Herald, Norristown, Pennsylvania (1 December 1978)

- They think that the cure to big government is to have bigger government... the only effective cure is to reduce the scope of government - get government out of the business.

- Is there some society you know that doesn't run on greed? You think Russia doesn't run on greed? You think China doesn't run on greed? What is greed? Of course, none of us are greedy, it's only the other fellow who's greedy. The world runs on individuals pursuing their separate interests. The great achievements of civilization have not come from government bureaus. Einstein didn't construct his theory under order from a bureaucrat. Henry Ford didn't revolutionize the automobile industry that way. In the only cases in which the masses have escaped from the kind of grinding poverty you're talking about, the only cases in recorded history, are where they have had capitalism and largely free trade. If you want to know where the masses are worse off, worst off, it's exactly in the kinds of societies that depart from that. So that the record of history is absolutely crystal clear that there is no alternative way, so far discovered, of improving the lot of the ordinary people that can hold a candle to the productive activities that are unleashed by the free-enterprise system.

- from an interview with Phil Donahue (1979): partial transcript from SiP TV ; or find link to full interview in the External links Section

- "The strongest argument for free enterprise is that it prevents anybody from having too much power. Whether that person is a government official, a trade union official, or a business executive. If forces them to put up or shut up. They either have to deliver the goods, produce something that people are willing to pay for, are willing to buy, or else they have to go into a different business."

- From The Tyranny of Control, an episode of the PBS Free to Choose television series (1980, vol. 2 transcript)

- [I]t is very hard to achieve good objectives through bad means. And the means we have been using are bad in two very different respects. In the first place, all of these programs involve some people spending other people’s money for objectives that are determined by still a third group of people. Nobody spends somebody else’s money as carefully as he spends his own. Nobody has the same dedication to achieving somebody else’s objectives that he displays when he pursues his own. Beyond this, the [welfare] programs have an insidious effect on the moral fiber of both the people who administer the programs and the people who are supposedly benefiting from it. For the people who administer it, it instills in them a feeling of almost Godlike power. For the people who are supposedly benefiting it instills a feeling of childlike dependence. Their capacity for personal decision making atrophies. The result is that the programs involved are misuse of money, they do not achieve the objectives which it was their intention to achieve. But far more important than this, they tend to rot away the very fabric that holds a decent society together.

- “Free to Choose: From Cradle to Grave,” episode 4, PBS telecast the series (1980)

- Whether it is in the slums of New Delhi or in the affluence of Las Vegas, it simply isn't fair that there should be any losers. Life is unfair — there is nothing fair about one man being born blind and another man being born with sight. There is nothing fair about one man being born of a wealthy parent and one of an impecunious parent. There is nothing fair about Muhammad Ali having been born with a skill that enables him to make millions of dollars one night. There is nothing fair about Marlene Dietrich having great legs that we all want to watch. There is nothing fair about any of that. But on the other hand, don't you think a lot of people who like to look at Marlene Dietrich's legs benefited from nature's unfairness in producing a Marlene Dietrich. What kind of a world would it be if everybody was an absolute identical duplicate of anybody else. You might as well destroy the whole world and just keep one specimen left for a museum. In the same way, it's unfair that Muhammad Ali should be a great fighter and should be able to earn millions. But would it not be even more unfair to the people who like to watch him if you said that in the pursuit of some abstract idea of equality we're not going to let Muhammad Ali get more for one nights fight than the lowest man on the totem pole can get for a days unskilled work on the docks. You can do that but the result of that would be to deny people the opportunity to watch Muhammad Ali. I doubt very much he would be willing to subject himself to the kind of fights he's gone through if he were to get the pay of an unskilled docker.

- From Created Equal, an episode of the PBS Free to Choose television series (1980, vol. 5 transcript).

- Society doesn't have values. People have values.

- From Created Equal, an episode of the PBS Free to Choose television series (1980, vol. 5 transcript).

- The society that puts equality before freedom will end up with neither. The society that puts freedom before equality will end up with a great measure of both.

- From Created Equal, an episode of the PBS Free to Choose television series (1980, vol. 5 transcript).

- There is no place for government to prohibit consumers from buying products the effect of which will be to harm themselves.

- From Who protects the consumer?, an episode of the PBS Free to Choose television series (1980, vol. 7 transcript)

- Governments never learn. Only people learn.

- Statement made in 1980, as quoted in The Cynic's Lexicon : A Dictionary Of Amoral Advice (1984), by Jonathon Green, p. 77

- Nothing is so permanent as a temporary government program.

- Tyranny of the Status Quo, San Diego, CA: Harcourt Brace Jovanovich (1980) p. 115

- Will we read next that government control of prices has created a shortage of sand in the Sahara?

- “Things That Ain’t So by Milton Friedman”, Newsweek (March 10, 1980) p. 79

- With some notable exceptions, businessmen favor free enterprise in general but are opposed to it when it comes to themselves.

- Lecture "The Suicidal Impulse of the Business Community" (1983); cited in Filters Against Folly (1985) by Garrett Hardin ISBN 067080410X

- The broader and more influential organisations of businessmen have acted to undermine the basic foundation of the free market system they purport to represent and defend.

- Lecture "The Suicidal Impulse of the Business Community" (1983); cited in Filters Against Folly (1985) by Garrett Hardin

- Every friend of freedom... must be as revolted as I am by the prospect of turning the United States into an armed camp, by the vision of jails filled with casual drug users and of an army of enforcers empowered to invade the liberty of citizens on slight evidence.

- "An Open Letter to Bill Bennett" in The Wall Street Journal (7 September 1989)

- Spending by government currently amounts to about 45 percent of national income. By that test, government owns 45 percent of the means of production that produce the national income. The U.S. is now 45 percent socialist.

- Article "We Have Socialism, Q.E.D." in The New York Times (31 December 1989)

- So far, twenty-two people have received the Nobel award in economics. Not one of them has been female—so, to judge only from the past, the most important thing to do if you want to be a Nobel laureate is to be male. I hasten to add that the absence of females is not, I believe, attributable to male chauvinist bias on the part of the Swedish Nobel Committee. I believe that the economics profession as a whole would have been nearly unanimous that, during the period in question, only one female candidate met the relevant standards—the English economist Joan Robinson, who has since died. The failure of the Nobel Committee to award her a prize may well have reflected bias but not sex bias. The economists here will understand what I am talking about. … A second requirement is to be a U.S. citizen. Twelve of the twenty-two recipients of the Nobel Prize were from the United States, four from the United Kingdom, two from Sweden, and one each from four other countries. … Of the twelve Americans who have won the Nobel Prize in economics, nine either studied or taught at the University of Chicago. So the next lesson is to go to the University of Chicago.

- "Milton Friedman", lecture in March 1985, published in William Breit and Roger W. Spencer (ed.) Lives of the laureates (5th ed., 2009)

- The most unresolved problem of the day is precisely the problem that concerned the founders of this nation: how to limit the scope and power of government. Tyranny, restrictions on human freedom, come primarily from governmental restrictions that we ourselves have set up.

- ”“Interview with Milton Friedman”, David Levy, Federal Reserve Bank of Minneapolis (June 1, 1992)

- The great virtue of a free market system is that it does not care what color people are; it does not care what their religion is; it only cares whether they can produce something you want to buy. It is the most effective system we have discovered to enable people who hate one another to deal with one another and help one another.

- "Why Government Is the Problem" (February 1, 1993), p. 19

- After the fall of communism, everybody in the world agreed that socialism was a failure. Everybody in the world, more or less, agreed that capitalism was a success. And every capitalist country in the world apparently deduced from that what the West needed was more socialism.

- Milton Friedman: The Rise of Socialism is Absurd and There’s No Such Thing as a Free Lunch, Grand opening speech at Cato Institutes’ headquarters in Washington, D.C. (May 1993)

- Thank heaven that we don’t get all of the government that we are made to pay for.

- Quoted in the House of Lords, (Nov. 24, 1994), also in Oxford Dictionary of Modern Quotes, Third Edition, Elizabeth Knowles, edit., Oxford University Press (2007) p. 124

- The stock of money, prices and output was decidedly more unstable after the establishment of the Reserve System than before. The most dramatic period of instability in output was, of course, the period between the two wars, which includes the severe (monetary) contractions of 1920-1, 1929-33, and 1937-8. No other 20 year period in American history contains as many as three such severe contractions.

This evidence persuades me that at least a third of the price rise during and just after World War I is attributable to the establishment of the Federal Reserve System... and that the severity of each of the major contractions — 1920-1, 1929-33 and 1937-8 is directly attributable to acts of commission and omission by the Reserve authorities...

Any system which gives so much power and so much discretion to a few men, [so] that mistakes — excusable or not — can have such far reaching effects, is a bad system. It is a bad system to believers in freedom just because it gives a few men such power without any effective check by the body politic — this is the key political argument against an independent central bank...

To paraphrase Clemenceau, money is much too serious a matter to be left to the central bankers.- As quoted in The Money Masters (1995)

- I know of no severe depression, in any country or any time, that was not accompanied by a sharp decline in the stock of money and equally of no sharp decline in the stock of money that was not accompanied by a severe depression.

- As quoted in The Money Masters (1995)

- Joan Robinson, a leading Keynesian and radical, produced a specimen for me to analyze. I said something like, "This is obviously the writing of a foreigner, so it's difficult for me to analyze. But I would say it is written by someone who had considerable artistic but not much intellectual talent." It turned out to be the handwriting of Lydia Lopokova, the world-famous Russian ballerina whom Keynes had married. That was surely my greatest triumph of the year at Cambridge!

- Two Lucky People

- In the course of General Westmoreland's testimony, he made the statement that he did not want to command an army of mercenaries. I stopped him and said, 'General, would you rather command an army of slaves?' He drew himself up and said, 'I don't like to hear our patriotic draftees referred to as slaves.' I replied, 'I don't like to hear our patriotic volunteers referred to as mercenaries.' But I went on to say, 'If they are mercenaries, then I, sir, am a mercenary professor, and you, sir, are a mercenary general; we are served by mercenary physicians, we use a mercenary lawyer, and we get our meat from a mercenary butcher.' That was the last that we heard from the general about mercenaries.

- Two Lucky People: Memoirs, Chicago: University of Chicago Press (1998) p. 380.

- There's a smokestack on the back of every government program.

- Interview (10 February 1999) in the video production Take It To The Limits: Milton Friedman on Libertarianism.

- The unions might be good for the people who are in the unions but it doesn't do a thing for the people who are unemployed. Because the union keeps down the number of jobs, it doesn't do a thing for them.

- Interview with Brian Lamb, In Depth Book TV (2000)

- The only way that has ever been discovered to have a lot of people cooperate together voluntarily is through the free market. And that’s why it’s so essential to preserving individual freedom.

- PBS “Interview: On freedom and free markets” Commanding Heights series (Oct. 1, 2000)

- The most important single central fact about a free market is that no exchange takes place unless both parties benefit.

- PBS “Interview: On freedom and free markets” Commanding Heights series (Oct. 1, 2000)

- I was not in Chile as a guest of the government. I was in Chile as the guest of a private organization… I must say, it's such a wonderful example of a double standard, because I had spent time in Yugoslavia, which was a communist country. I later gave a series of lectures in China. When I came back from communist China, I wrote a letter to the Stanford Daily newspaper in which I said, '"It's curious. I gave exactly the same lectures in China that I gave in Chile. I have had many demonstrations against me for what I said in Chile. Nobody has made any objections to what I said in China. How come?"

- “Commanding Heights, Interview on PBS”, (Oct. 1, 2000)

- The Chilean economy did very well, but more important, in the end the central government, the military junta, was replaced by a democratic society. So the really important thing about the Chilean business is that free markets did work their way in bringing about a free society.

- “Commanding Heights, Interview on PBS”, (Oct. 1, 2000)

- I think it is only because capitalism has proved so enormously more efficient than alternative methods that it has survived at all. (...) I'm not sure capitalism is the right word. There is a sense in which every society is capitalist. The Soviet Union was capitalist, but it was state capitalism. Latin American societies in the past have been capitalist, but it has been oligarchic capitalism. So what we really need to talk about is not capitalism but free market or competitive capitalism which is the system that we would like to have adopted, not just capitalism.

- Interview with Parker in Randall E. Parker(ed.), Reflections on the Great Depression (2002)

- The use of quantity of money as a target has not been a success. I'm not sure that I would as of today push it as hard as I once did.

- Financial Times [UK] (7 June 2003)

- There are four ways in which you can spend money. You can spend your own money on yourself. When you do that, why then you really watch out what you’re doing, and you try to get the most for your money. Then you can spend your own money on somebody else. For example, I buy a birthday present for someone. Well, then I’m not so careful about the content of the present, but I’m very careful about the cost. Then, I can spend somebody else’s money on myself. And if I spend somebody else’s money on myself, then I’m sure going to have a good lunch! Finally, I can spend somebody else’s money on somebody else. And if I spend somebody else’s money on somebody else, I’m not concerned about how much it is, and I’m not concerned about what I get. And that’s government. And that’s close to 40% of our national income.

- "'Your World' Interview With Economist Milton Friedman" Fox News interview (May 2004)

- I am a libertarian with a small "l" and a Republican with a capital "R". And I am a Republican with a capital "R" on grounds of expediency, not on principle.

- You must distinguish sharply between being pro free enterprise and being pro business.

- I am in favor of cutting taxes under any circumstances and for any excuse, for any reason, whenever it's possible. … because I believe the big problem is not taxes, the big problem is spending. I believe our government is too large and intrusive, that we do not get our money's worth for the roughly 40 percent of our income that is spent by government … How can we ever cut government down to size? I believe there is one and only one way: the way parents control spendthrift children, cutting their allowance. For government, that means cutting taxes.

- As quoted in Conservatives Betrayed: How George W. Bush and other big government Republicans hijacked the conservative cause (2006) by Richard A Viguerie, p. 46

- Keynes was a great economist. In every discipline, progress comes from people who make hypotheses, most of which turn out to be wrong, but all of which ultimately point to the right answer. Now Keynes, in The General Theory of Employment, Interest and Money, set forth a hypothesis which was a beautiful one, and it really altered the shape of economics. But it turned out that it was a wrong hypothesis. That doesn't mean that he wasn't a great man!

- As quoted in Opinion Journal (22 July 2006)

- Thanks to economists, all of us, from the days of Adam Smith and before right down to the present, tariffs are perhaps one tenth of one percent lower than they otherwise would have been. … And because of our efforts, we have earned our salaries ten-thousand fold.

- Speaking at a meeting of the American Economic Association, as quoted by Walter Block in "Milton Friedman RIP" in Mises Daily (16 November 2006)

- If a tax cut increases government revenues, you haven't cut taxes enough.

- As quoted in "Milton Friedman's Last Lunch" at Forbes.com (11 December 2006)

- The true test of any scholar's work is not what his contemporaries say, but what happens to his work in the next 25 or 50 years. And the thing that I will really be proud of is if some of the work I have done is still cited in the text books long after I am gone.

- As quoted in The Power of Choice (January 2007)

- I’m in favor of legalizing drugs. According to my values system, if people want to kill themselves, they have every right to do so. Most of the harm that comes from drugs is because they are illegal.

- As quoted in If Ignorance Is Bliss, Why Aren't There More Happy People? (2009) by John Mitchinson, p. 87

Capitalism and Freedom (1962)

[edit]

- There is enormous inertia—a tyranny of the status quo—in private and especially governmental arrangements. Only a crisis—actual or perceived—produces real change. When that crisis occurs, the actions that are taken depend on the ideas that are lying around. That, I believe, is our basic function: to develop alternatives to existing policies, to keep them alive and available until the politically impossible becomes politically inevitable.

- Preface (1982 edition), p. ix

- President Kennedy said, ‘Ask not what your country can do for you —ask what you can do for your country.’… Neither half of that statement expresses a relation between the citizen and his government that is worthy of the ideals of free men in a free society. ‘What your country can do for you’ implies that the government is the patron, the citizen the ward. ‘What you can do for your country’ assumes that the government is the master, the citizen the servant.

- Introduction, p. 1

- To the free man, the country is the collection of individuals who compose it, not something over and above them. He is proud of a common heritage and loyal to common traditions. But he regards government as a means, an instrumentality, neither a grantor of favors and gifts, nor a master or god to be blindly worshipped and served.

- Introduction, p. 2

- The free man will ask neither what his country can do for him nor what he can do for his country. He will ask rather 'What can I and my compatriots do through government' to help us discharge our individual responsibilities, to achieve our several goals and purposes, and above all, to protect our freedom? And he will accompany this question with another: How can we keep the government we create from becoming a Frankenstein that will destroy the very freedom we establish it to protect? Freedom is a rare and delicate plant. Our minds tell us, and history confirms, that the great threat to freedom is the concentration of power. Government is necessary to preserve our freedom, it is an instrument through which we can exercise our freedom; yet by concentrating power in political hands, it is also a threat to freedom. Even though the men who wield this power initially be of good will and even though they be not corrupted by the power they exercise, the power will both attract and form men of a different stamp.

- Introduction, p. 2

- The preservation of freedom is the protective reason for limiting and decentralizing governmental power. But there is also a constructive reason. The great advances of civilization, whether in architecture or painting, in science or literature, in industry or agriculture, have never come from centralized government. … Government can never duplicate the variety and diversity of individual action.

- Introduction, pp. 2-3

- The power to do good is also the power to do harm; those who control the power today may not tomorrow; and, more important, what one man regards as good, another may regard as harm.

- Introduction, p. 3

- By relying primarily on voluntary co-operation and private enterprise, in both economic and other activities, we can insure that the private sector is a check on the powers of the governmental sector and an effective protection of freedom of speech, of religion, and of thought.

- Introduction, p. 3

- As it developed in the late eighteenth and early nineteenth centuries, the intellectual movement that went under the name of liberalism emphasized freedom as the ultimate goal and the individual as the ultimate entity in the society. It supported laissez faire at home as a means of reducing the role of the state in economic affairs and thereby enlarging the role of the individual; it supported free trade abroad as a means of linking the nations of the world together peacefully and democratically. In political matters, it supported the development of representative government and of parliamentary institutions, reduction in the arbitrary power of the state, and protection of the civil freedoms of individuals.

- Introduction, p. 5

- The nineteenth-century liberal regarded an extension of freedom as the most effective way to promote welfare and equality; the twentieth-century liberal regards welfare and equality as either prerequisites of or alternatives to freedom.

- Introduction, p. 5

- Because we live in a largely free society, we tend to forget how limited is the span of time and the part of the globe for which there has ever been anything like political freedom: the typical state of mankind is tyranny, servitude, and misery. The nineteenth century and early twentieth century in the Western world stand out as striking exceptions to the general trend of historical development. Political freedom in this instance clearly came along with the free market and the development of capitalist institutions. So also did political freedom in the golden age of Greece and in the early days of the Roman era.

History suggests only that capitalism is a necessary condition for political freedom. Clearly it is not a sufficient condition.- Ch. 1 The Relation Between Economic Freedom and Political Freedom, 2002 edition, p. 10

- As liberals, we take freedom of the individual, or perhaps the family, as our ultimate goal in judging social arrangements. Freedom as a value in this sense has to do with the interrelations among people

- Ch. 1 The Relation Between Economic Freedom and Political Freedom, p. 12

- The liberal conceives of men as imperfect beings. He regards the problem of social organization to be as much a negative problem of preventing 'bad' people from doing harm as of enabling 'good' people to do good; and, of course, 'bad' and 'good' people may be the same people, depending on who is judging them.

- Ch. 1 The Relation Between Economic Freedom and Political Freedom, p. 12

- The basic problem of social organization is how to co-ordinate the economic activities of large numbers of people.

- Ch. 1 The Relation Between Economic Freedom and Political Freedom, p. 12

- Fundamentally, there are only two ways of coordinating the economic activities of millions. One is central direction involving the use of coercion—the technique of the army and of the modern totalitarian state. The other is voluntary co-operation of individuals—the technique of the market place.

- Ch. 1 The Relation Between Economic Freedom and Political Freedom, pp. 12-13

- Political freedom means the absence of coercion of a man by his fellow men. The fundamental threat to freedom is power to coerce, be it in the hands of a monarch, a dictator, an oligarchy, or a momentary majority. The preservation of freedom requires the elimination of such concentration of power to the fullest possible extent and the dispersal and distribution of whatever power cannot be eliminated — a system of checks and balances.

- Ch. 1 The Relation Between Economic Freedom and Political Freedom, p. 15

- The existence of a free market does not of course eliminate the need for government. On the contrary, government is essential both as a forum for determining the 'rule of the game' and as an umpire to interpret and enforce the rules decided on.

- Ch. 1 The Relation Between Economic Freedom and Political Freedom, 2002 edition, p. 15

- A major source of objection to a free economy is precisely that it … gives people what they want instead of what a particular group thinks they ought to want. Underlying most arguments against the free market is a lack of belief in freedom itself.

- Ch. 1 The Relation Between Economic Freedom and Political Freedom, 2002 edition, page 15

- The widespread use of the market reduces the strain on the social fabric by rendering conformity unnecessary with respect to any activities it encompasses. The wider the range of activities covered by the market, the fewer are the issues on which explicitly political decisions are required and hence on which it is necessary to achieve agreement. In turn, the fewer the issues on which agreement is necessary, the greater is the likelihood of getting agreement while maintaining a free society.

- Ch. 2 The Role of Government in a Free Society, p. 24

- The need for government in these respects arises because absolute freedom is impossible. However attractive anarchy may be as a philosophy, it is not feasible in a world of imperfect men.

- Ch. 2 The Role of Government in a Free Society, p. 25

- The organization of economic activity through voluntary exchange presumes that we have provided, through government, for the maintenance of law and order to prevent coercion of one individual by another, the enforcement of contracts voluntarily entered into, the definition of the meaning of property rights, the interpretation and enforcement of such rights, and the provision of a monetary framework.

- Ch. 2 The Role of Government in a Free Society, p. 27

- Exchange is truly voluntary only when nearly equivalent alternatives exist. Monopoly implies the absence of alternatives and thereby inhibits effective freedom of exchange.

- Ch. 2, The Role of Government in a Free Society, p. 28

- Freedom is a tenable objective only for responsible individuals. We do not believe in freedom for madmen or children. The necessity of drawing a line between responsible individuals and others is inescapable, yet it means that there is an essential ambiguity in our ultimate objective of freedom. Paternalism is inescapable for those whom we designate as not responsible.

- Ch. 2 The Role of Government in a Free Society, p. 33

- A government which maintained law and order, defined property rights, served as a means whereby we could modify property rights and other rules of the economic game, adjudicated disputes about the interpretation of the rules, enforced contracts, promoted competition, provided a monetary framework, engaged in activities to counter technical monopolies and to overcome neighborhood effects widely regarded as sufficiently important to justify government intervention, and which supplemented private charity and the private family in protecting the irresponsible, whether madman or child—such a government would clearly have important functions to perform. The consistent liberal is not an anarchist.

- Ch. 2 The Role of Government in a Free Society, p. 34

- A liberal is fundamentally fearful of concentrated power. His objective is to preserve the maximum degree of freedom for each individual separately that is compatible with one man's freedom not interfering with other men's freedom. He believes that this objective requires that power be dispersed. He is suspicious of assigning to government any functions that can be performed through the market, both because this substitutes coercion for voluntary co-operation in the area in question and because, by giving government an increased role, it threatens freedom in other areas.

- Ch. 3 The Control of Money, p. 39

- The Great Depression in the United States, far from being a sign of the inherent instability of the private enterprise system, is a testament to how much harm can be done by mistakes on the part of a few men when they wield vast power over the monetary system of a country.

- Ch. 3 The Control of Money, p. 50

- To paraphrase Clemenceau, money is much too serious a matter to be left to the Central Bankers.

- Ch. 3 The Control of Money, p. 50-51

- With respect to teachers' salaries .... Poor teachers are grossly overpaid and good teachers grossly underpaid. Salary schedules tend to be uniform and determined far more by seniority.

- Ch. 6 The Role of Government in Education, p. 95

- The view has been gaining widespread acceptance that corporate officials and labor leaders have a "social responsibility"... beyond serving the interests of their stockholders or their members. This view shows a fundamental misconception of the character of a free economy. In such an economy there is one and only one social responsibility of business—to use its resources and engage in activities designed to increase its profits so long as it stays within the rules of the game, which is to say, engages in open and free competition without deception or fraud. Similarly, the "social responsibility" of labor leaders is to serve the interests of the members of their unions. It is the responsibility of the rest of us to establish a framework of law such that an individual... is, to quote Adam Smith... "led by an invisible hand... I have never known much good done by those who affected to trade for the public good."

- Ch. 8 Monopoly and the Social Responsibility of Business and Labor, p. 133

- Few trends could so thoroughly undermine the very foundations of our free society as the acceptance by corporate officials of a social responsibility other than to make as much money for their stockholders as possible. This is a fundamentally subversive doctrine. If businessmen do have a social responsibility other than making maximum profits for stockholders, how are they to know what it is? Can self-selected private individuals decide what the social interest is? Can they decide how great a burden they are justified in placing on themselves or their stockholders to serve that social interest?

- Ch. 8 Monopoly and the Social Responsibility of Business and Labor, p. 133

- Those of us who believe in freedom must believe also in the freedom of individuals to make their own mistakes. If a man knowingly prefers to live for today, to use his resources for current enjoyment, deliberately choosing a penurious old age, by what right do we prevent him from doing so? We may argue with him, seek to persuade him that he is wrong, but are we entitled to use coercion to prevent him from doing what he chooses to do? Is there not always the possibility that he is right and that we are wrong? Humility is the distinguishing virtue of the believer in freedom; arrogance, of the paternalist.

- Ch. 11, Social Welfare Measures, p. 187

- The major disadvantage of the proposed negative income tax is its political implications. It establishes a system under which taxes are imposed on some to pay subsidies to others. And presumably, these others have a vote.

- Ch. 12 The Alleviation of Poverty, 2002 edition, p. 194

- The heart of the liberal philosophy is a belief in the dignity of the individual, in his freedom to make the most of his capacities and opportunities according to his own lights, subject only to the proviso that he not interfere with the freedom of other individuals to do the same. This implies a belief in the equality of man in one sense; in their inequality in another.

- Ch. 12 The Alleviation of Poverty, 2002 edition, p. 195

- An income tax intended to reduce inequality and promote the diffusion of wealth has in practice fostered reinvestment of corporate earnings, thereby favoring the growth of large corporations, inhibiting the operation of the capital market, and discouraging the establishment of new enterprises.

- Ch. 13 Conclusion, 2002 edition, p. 198

- As Adam Smith once said, 'There is much ruin in a nation'. Our basic structure of values and the interwoven network of free institutions will withstand much. I believe that we shall be able to preserve and extend freedom despite the size of the military programs and despite the economic powers already concentrated in Washington. But we shall be able to do so only if we awake to the threat that we face, only if we persuade our fellowmen that free institutions offer a surer, if perhaps at times a slower, route to the ends they seek than the coercive power of the state. The glimmerings of change that are already apparent in the intellectual climate are a hopeful augury.

- Ch. 13 Conclusion, 2002 edition, p. 202

- Concentrated power is not rendered harmless by the good intentions of those who create it.

- Ch. 13 Conclusion, p. 201

A Monetary History of the United States (1963)

[edit]- The contraction from 1929 to 1933 was by far the most severe business-cycle contraction during the near-century of U.S. history we cover and it may well have been the most severe in the whole of U.S. history.

- "The Great Contraction, 1929-1933" (1963), with Anna J. Schwartz

An Economist's Protest: Columns in Political Economy (1966)

[edit]Glen Ridge, NJ, Thomas Horton and Company, 1966

- The key need in policy-setting is to reverse the growth of government!

- p. xvi

- The elementary fact is that ‘business’ does not and cannot pay taxes. Only people can pay taxes. Corporate officials may sign the check, but the money that they forward to Internal Revenue comes from the corporation’s employees, customers, or stockholders.

- p. 86

- We have heard much these past few years of how the government protects the consumer. A far more urgent problem is to protect the consumer from the government.

- p. 107

- A military draft is undesirable and unnecessary. We can and should man our armed forces with volunteers—as the United States has traditionally done except in major wars.

- p. 121

- In a free society, a government has no business using the power of the law or the taxpayer's money to propagandize for some views and to prevent the transmission of others.

- p. 153

- There is an invisible hand in politics that operates in the opposite direction to the invisible hand in the market.

- p. 143

- The old saw is that the Quakers went to the New World to do good and ended up doing well. Today, well-meaning reformers go to Washington to do good and end up doing harm.

- p. 155

- Legalizing drugs would simultaneously reduce the amount of crime and raise the quality of law enforcement.

- p. 161

- I am convinced that the minimum-wage law is the most anti-Negro law on our statute books—in its effect, not its intent.

- p. 163

- The draft is inequitable because irrelevant considerations play so large a role in determining who serves. It is wasteful because deferment of students, fathers, and married men jams colleges, raises the birth rate, and fuels divorce court. It is inconsistent with a free society because it exacts compulsory service from some and limits the freedom of others to travel abroad, emigrate, or even to talk and act freely. So long as compulsion is retained, these defects are inevitable.

- p. 189 (1975 edition)

“A Friedman doctrine‐- The Social Responsibility Of Business Is to Increase Its Profits” (Sept. 1970)

[edit]

- "A Friedman doctrine‐- The Social Responsibility Of Business Is to Increase Its Profits" in The New York Times Magazine (13 September 1970), Section SM, Page 17. Archived from the original on September 14, 2020.

- What does it mean to say that “business” has responsibilities? Only people can have responsibilities. A corporation is an artificial person and in this sense may have artificial responsibilities, but “business” as a whole cannot be said to have responsibilities, even in this vague sense.

- IN a free‐enterprise, private‐property system, a corporate executive is an employe of the owners of the business. He has direct responsibility to his employers. That responsibility is to conduct the business in accordance with their desires, which generally will be to make as much money as possible while conforming to the basic rules of the society, both those embodied in law and those embodied in ethical custom. Of course, in some cases his employers may have a different objective. A group of persons might establish a corporation for an eleemosynary purpose—for example, a hospital or school. The manager of such a corporation will not have money profit as his objective but the rendering of certain services. In either case, the key point is that, in his capacity as a corporate executive, the manager is the agent of the individuals who own the corporation or establish the eleemosynary institution, and his primary responsibility is to them.

- What does it mean to say that the corporate executive has a “social responsibility” in his capacity as businessman? If this statement is not pure rhetoric, it must mean that he is to act in some way that is not in the interest of his employers. For example, that he is to refrain from increasing the price of the product in order to contribute to the social objective of preventing inflation, even though a price increase would be in the best interests of the corporation. Or that he is to make expenditures on reducing pollution beyond the amount that is in the best interests of the corporation or that is required by law in order to contribute to the social objective of improving the environment. Or that, at the expense of corporate profits, he is to hire “hard core” unemployed instead of better qualified available workmen to contribute to the social objective of reducing poverty. In each of these cases, the corporate executive would be spending someone else's money for a general social interest.

- Insofar as his actions in accord with his “social responsibility” reduce returns to stock holders, he is spending their money. Insofar as his actions raise the price to customers, he is spending the customers’ money. Insofar as his actions lower the wages of some employes, he is spending their money. The stockholders or the customers or the employes could separately spend their own money on the particular action if they wished to do so. The executive is exercising a distinct “social responsibility,” rather than serving as an agent of the stockholders or the customers or the employes, only if he spends the money in a different way than they would have spent it. But if he does this, he is in effect imposing taxes, on the one hand, and deciding how the tax proceeds shall be spent, on the other. This process raises political questions on two levels: principle and consequences. On the level of political principle, the imposition of taxes and the expenditure of tax proceeds are governmental functions. We have established elaborate constitutional, parliamentary and judicial provisions to control these functions, to assure that taxes are imposed so far as possible in accordance with the preferences and desires of the public — after all, "taxation without representation" was one of the battle cries of the American Revolution. We have a system of checks and balances to separate the legislative function of imposing taxes and enacting expenditures from the executive function of collecting taxes and administering expenditure programs and from the judicial function of mediating disputes and interpreting the law.

Here the businessman — self-selected or appointed directly or indirectly by stockholders — is to be simultaneously legislator, executive and, jurist. He is to decide whom to tax by how much and for what purpose, and he is to spend the proceeds — all this guided only by general exhortations from on high to restrain inflation, improve the environment, fight poverty and so on and on.

- The whole justification for permitting the corporate executive to be selected by the stockholders is that the executive is an agent serving the interests of his principal. This justification disappears when the corporate executive imposes taxes and spends the proceeds for “social” purposes. He becomes in effect a public employe, a civil servant, even though he remains in name an employe of private enterprise. On grounds of political principle, it is intolerable that such civil servants—insofar as their actions in the name of social responsibility are real and not just window‐dressing—should be selected as they are now. If they are to be civil servants, then they must be selected through a political process. If they are to impose taxes and make expenditures to foster “social” objectives, then political machinery must be set up to guide the assessment of taxes and to determine through a political process the objectives to be served. This is the basic reason why the doctrine of “social responsibility” involves the acceptance of the socialist view that political mechanisms, not market mechanisms, are the appropriate way to determine the allocation of scarce resources to alternative uses.

- The difficulty of exercising “social responsibility” illustrates, of course, the great virtue of private competitive enterprise — it forces people to be responsible for their own actions and makes it difficult for them to “exploit” other people for either selfish or unselfish purposes. They can do good—but only at their own expense.

- In a free society, it is hard for “good” people to do “good,” but that is a small price to pay for making it hard for “evil” people to do “evil,” especially since one man's good is anther's evil.

- I have been impressed time and again by the schizophrenic character of many businessmen. They are capable of being extremely far‐sighted and clear‐headed in matters that are internal to their businesses. They are incredibly short sighted and muddle‐headed in mat ters [sic!] that are outside their businesses but affect the possible survival of business in general. This short sightedness is strikingly exemplified in the calls from many businessmen for wage and price guidelines or controls or incomes policies. There is nothing that could do more in a brief period to destroy a market system and replace it by a centrally controlled system than effective governmental control of prices and wages. The short‐sightedness is also exemplified in speeches by business men on social responsibility. This may gain them kudos in the short run. But it helps to strengthen the already too prevalent view that the ptirsuit [sic!] of profits is wicked and im moral [sic!] and must be curbed and controlled by external forces. Once this view is adopted, the external forces that curb the market will not be the social consciences, however highly developed, of the pontificating executives; it will be the iron fist of Government bureaucrats. Here, as with price and wage controls, business men seem to me to reveal a suicidal impulse.

- The political principle that underlies the market mechanism is unanimity. In an ideal free market resting on private property, no individual can coerce any other, all cooperation is voluntary, all parties to such cooperation benefit or they need not participate. There are no values, no "social" responsibilities in any sense other than the shared values and responsibilities of individuals. Society is a collection of individuals and of the various groups they voluntarily form.

The political principle that underlies the political mechanism is conformity. The individual must serve a more general social interest — whether that be determined by a church or a dictator or a majority. The individual may have a vote and say in what is to be done, but if he is overruled, he must conform. It is appropriate for some to require others to contribute to a general social purpose whether they wish to or not.

Unfortunately, unanimity is not always feasible. There are some respects in which conformity appears unavoidable, so I do not see how one can avoid the use of the political mechanism altogether. But the doctrine of “social responsibility” taken seriously would extend the scope of the political mechanism to every human activity. It does not differ in philosophy from the most explicitly collectivist doctrine. It differs only by professing to believe that collectivist ends can be attained without collectivist means. That is why, in my book “Capitalism and Freedom,” I have called it a “fundamentally subversive doctrine” in a free society, and have said that in such a society, “there is one and only one social responsibility of business—to use its resources and engage in activities designed to increase its profits so long as it stays within the rules of the game, which is to say, engages in open and free competition without deception or fraud.”

“Interview with Milton Friedman”, Playboy magazine (Feb. 1973)

[edit]- What kind of society isn’t structured on greed?... So the problem of social organization is how to set up an arrangement under which greed will do the least harm. It seems to me that the great virtue of capitalism is that it’s that kind of system. Because under capitalism, the power of any one individual over his fellow man is relatively small.

- The government solution to a problem is usually as bad as the problem and very often makes the problem worse.

- We want the kind of world in which greedy people can do the least harm to their fellow men. That’s the kind of world in which power is widely dispersed and each of us has as many alternatives as possible.

- Perfect competition is a theoretical concept like the Euclidian line, which has no width or depth. Just as we’ve never seen that line there has never been truly free enterprise.

- How much attention is paid to agreement between Galbraith and myself in opposing a draft and favoring an all-volunteer armed force, or in opposing tariffs and favoring free trade, or on a host of other issues? What is newsworthy is that Galbraith endorses wage and price controls, while I oppose them.

- Just as banks all around the country were closing, the Fed raised the discount rate; that's the rate they charge for loans to banks. Bank failures consequently increased spectacularly. We might have had an economic downturn in the thirties anyway, but in the absence of the Federal Reserve System—with its enormous power to make a bad situation worse—it wouldn't have been anything like the scale we experienced.

- Although I wish the anarchists luck, since that’s the way we ought to be moving now. But I believe we need government to enforce the rules of the game. By prosecuting anti-trust violations, for instance. We need a government to maintain a system of courts that will uphold contracts and rule on compensation for damages. We need a government to ensure the safety of its citizens–to provide police protection. But government is failing at a lot of these things that it ought to be doing because it’s involved in so many things it shouldn’t be doing.

- The essence of the problem is that once we begin to allow exceptions for special interests, we move from a system of private arrangements to a political system where everyone’s freedom is limited and government becomes a matter of trying to balance those interests. Nobody really wins under these terms.

- Even the most ardent environmentalist doesn’t really want to stop pollution. If he thinks about it and doesn’t just talk about it, he wants to have the right amount of pollution. We can’t really afford to eliminate it—not without abandoning all the benefits of technology that we not only enjoy but on which we depend. So the answer is to allow only pollution that’s worth what it costs, and not any pollution that isn’t worth what it costs.

- The average income of blacks here is far higher than the average income of all the people in the Soviet Union. The official government definition of the poverty line in the U.S. is higher than the average income in the Soviet Union; it’s higher than the income received by 90 percent of the people on the world’s surface. Now, that doesn’t mean blacks aren’t subject to injustice; of course they are.

- What country in the world today engages in the most extreme anti-Semitic persecution? The Soviet Union. It’s not an accident, because if you have a society with concentrated power, if you have a collectivist society, it’s going to be in a position to exercise the preferences and prejudices of its rulers. Moreover, it’s going to have an incentive to do so, because it’s going to need a scapegoat and it will choose some group like the Jews or the blacks to be the scapegoat.

Free to Choose (1980)

[edit]New York and London, Harcourt Brace Jovanovich, 1980

- The combination of economic and political power in the same hands is a sure recipe for tyranny.

- “Introduction”, p. 3

- The key insight of Adam Smith's Wealth of Nations is misleadingly simple: if an exchange between two parties is voluntary, it will not take place unless both believe they will benefit from it. Most economic fallacies derive from the neglect of this simple insight, from the tendency to assume that there is a fixed pie, that one party can gain only at the expense of another.

- Ch. 1 "The Power of the Market", p. 13

- The price system works so well, so efficiently, that we are not aware of it most of the time. We never realize how well it functions until it is prevented from functioning, and even then we seldom recognize the source of the trouble.

- Ch. 1 "The Power of the Market", p. 14

- Prices perform three functions in organizing economic activity: first, they transmit information; second, they provide an incentive to adopt those methods of production that are least costly and thereby use available resources for the most highly valued pur poses; third, they determine who gets how much of the product—the distribution of income. These three functions are closely in terrelated.

- Ch. 1 "The Power of the Market", p. 14

- The price system transmits only the important information and only to the people who need to know.

- Ch. 1 "The Power of the Market", 15

- When everybody owns something, nobody owns it, and nobody has a direct interest in maintaining or improving its condition. That is why buildings in the Soviet Union — like public housing in the United States — look decrepit within a year or two of their construction.

- Ch. 1 “The Power of the Market”, p. 24

- The supporters of tariffs treat it as self-evident that the creation of jobs is a desirable end, in and of itself, regardless of what the persons employed do. That is clearly wrong. If all we want are jobs, we can create any number—for example, have people dig holes and then fill them up again, or perform other useless tasks. Work is sometimes its own reward. Mostly, however, it is the price we pay to get the things we want. Our real objective is not just jobs but productive jobs—jobs that will mean more goods and services to consume.

- Ch. 2 “The Tyranny of Controls”, pp. 40-41

- Believers in aristocracy and socialism share a faith in centralized rule, in rule by command rather than by voluntary cooperation.

- Ch. 4 “Cradle to Grave”, p. 97

- As these remarks indicate, the Social Security program involves a transfer from the young to the old. To some extent such a transfer has occurred throughout history—the young supporting their parents, or other relatives, in old age. Indeed, in many poor countries with high infant death rates, like India, the desire to assure oneself of progeny who can provide support in old age is a major reason for high birth rates and large families. The difference between Social Security and earlier arrangements is that Social Security is compulsory and impersonal—earlier arrangements were voluntary and personal. Moral responsibility is an individual matter, not a social matter. Children helped their parents out of love or duty. They now contribute to the support of someone else’s parents out of compulsion and fear. The earlier transfers strengthened the bonds of the family; the compulsory transfers weaken them.

- Ch. 4 “Cradle to Grave”, p. 106

- When the law interferes with people's pursuit of their own values, they will try to find a way around. They will evade the law, they will break the law, or they will leave the country. Few of us believe in a moral code that justifies forcing people to give up much of what they produce to finance payments to persons they do not know for purposes they may not approve of. When the law contradicts what most people regard as moral and proper, they will break the law—whether the law is enacted in the name of a noble ideal such as equality or in the naked interest of one group at the expense of another. Only fear of punishment, not a sense of justice and morality, will lead people to obey the law.

- Ch. 5 “Created Equal”, p. 145

- In the past century a myth has grown up that free market capitalism—equality of opportunity as we have interpreted that term—increases such inequalities, that it is a system under which the rich exploit the poor. Nothing could be further from the truth. Wherever the free market has been permitted to operate, wherever anything approaching equality of opportunity has existed, the ordinary man has been able to attain levels of living never dreamed of before. Nowhere is the gap between rich and poor wider, nowhere are the rich richer and the poor poorer, than in those societies that do not permit the free market to operate.

- Ch. 5 “Created Equal”, p. 146

- Industrial progress, mechanical improvement, all of the great wonders of the modern era have meant little to the wealthy. The rich in ancient Greece would have benefited hardly at all from modern plumbing — running servants replaced running water. Television and radio — the patricians of Rome could enjoy the leading musicians and actors in their home, could have the leading artists as domestic retainers. Ready-to-wear clothing, supermarkets — all these and many other modern developments would have added little to their life. They would have welcomed the improvements in transportation and in medicine, but for the rest, the great achievements of western capitalism have rebounded primarily to the benefit of the ordinary person. These achievements have made available to the masses conveniences and amenities that were previously the exclusive prerogative of the rich and powerful.

- Ch. 5 “Created Equal”, p. 147

- A society that puts equality—in the sense of equality of outcome—ahead of freedom will end up with neither equality nor freedom. The use of force to achieve equality will destroy freedom, and the force, introduced for good purposes, will end up in the hands of people who use it to promote their own interests. On the other hand, a society that puts freedom first will, as a happy by-product, end up with both greater freedom and greater equality.

- Ch. 5 “Created Equal”, p. 148

- The threat to public schools arises from their defects, not their accomplishments. In small, closely knit communities where public schools, particularly elementary schools, are now reasonably satisfactory, not even the most comprehensive voucher plan would have much effect. The public schools would remain dominant, perhaps somewhat improved by the threat of potential competition. But elsewhere, and particularly in the urban slums where the public schools are doing such a poor job, most parents would undoubtedly try to send their children to nonpublic schools.

- Ch. 6 “What’s Wrong with Our Schools”, p. 170

- A worker is protected from his employer by the existence of other employers for who he can go to work. An employer is protected from exploitation by his employees by the existence of other workers whom he can hire. The consumer is protected from exploitation by a given seller by the existence of other sellers from whom he can buy.

- Ch. 8 "Who Protects the Workers?", p. 246

- The smaller the unit of government and the more restricted the functions assigned government, the less likely it is that its actions will reflect special interests rather than the general interest.

- Ch. 10 “The Tide Is Turning”, p. 314

America's Drug Forum interview (1991)

[edit]

- "America's Drug Forum" interview (1991)

- The proper role of government is exactly what John Stuart Mill said in the middle of the 19th century in On Liberty. The proper role of government is to prevent other people from harming an individual. Government, he said, never has any right to interfere with an individual for that individual's own good.

The case for prohibiting drugs is exactly as strong and as weak as the case for prohibiting people from overeating. We all know that overeating causes more deaths than drugs do. If it's in principle OK for the government to say you must not consume drugs because they'll do you harm, why isn't it all right to say you must not eat too much because you'll do harm? Why isn't it all right to say you must not try to go in for skydiving because you're likely to die? Why isn't it all right to say, "Oh, skiing, that's no good, that's a very dangerous sport, you'll hurt yourself"? Where do you draw the line?

- It does harm a great many other people, but primarily because it's prohibited. There are an enormous number of innocent victims now. You've got the people whose purses are stolen, who are bashed over the head by people trying to get enough money for their next fix. You've got the people killed in the random drug war. You've got the corruption of the legal establishment. You've got the innocent victims who are taxpayers who have to pay for more and more prisons, and more and more prisoners, and more and more police. You've got the rest of us who don't get decent law enforcement because all the law enforcement officials are busy trying to do the impossible.

And, last, but not least, you've got the people of Colombia and Peru and so on. What business do we have destroying and leading to the killing of thousands of people in Colombia because we cannot enforce our own laws? If we could enforce our laws against drugs, there would be no market for these drugs.

- It's a moral problem that the government is making into criminals people, who may be doing something you and I don't approve of, but who are doing something that hurts nobody else. Most of the arrests for drugs are for possession by casual users.

Now here's somebody who wants to smoke a marijuana cigarette. If he's caught, he goes to jail. Now is that moral? Is that proper? I think it's absolutely disgraceful that our government, supposed to be our government, should be in the position of converting people who are not harming others into criminals, of destroying their lives, putting them in jail. That's the issue to me. The economic issue comes in only for explaining why it has those effects. But the economic reasons are not the reasons.

- If you look at the drug war from a purely economic point of view, the role of the government is to protect the drug cartel. That's literally true.

- One role of prohibition is in making the drug market more lucrative.

Money Mischief (1992)

[edit]- The term money has two very different meanings in popular discourse. We often speak of someone "making money," when we really mean that he or she is receiving an income. We do not mean that he or she has a printing press in the basement churning out greenbacked pieces of paper. In this use, money is a synonym for income or receipts; it refers to a flow, to income or receipts per week or per year. We also speak of someone's having money in his or her pocket or in a safe-deposit box or on deposit at a bank. In that use, money refers to an asset, a component of one's total wealth. Put differently, the first use refers to an item on a profit-and-loss statement, the second to an item on a balance sheet

- Ch. 2 The Mystery of Money

- One reason why money is a mystery to so many is the role of myth or fiction or convention.

- Ch. 2 The Mystery of Money

- Why should they also be accepted by private persons in private transactions in exchange for goods and services?