Michael Lewis (author)

Appearance

Michael Lewis (born October 15, 1960) is an American contemporary non-fiction author and financial journalist. He is currently a contributing editor to Vanity Fair.

The Big Short (2010)

[edit]- I'd stumbled into a job at Salomon Brothers in 1985, and stumbled out, richer, in 1988, and even though I wrote a book about the experience, the whole thing still strikes me me as totally preposterous-which is one reason the money was so easy to walk away from.

- Prologue, Poltergeist, p. xiii (See also: Liar's Poker)

- I confess some part of me thought, If only I'd stuck around, this is the sort of catastrophe I might have created.

- Prologue, Poltergeist, p. xvii

- A thought crossed his mind: How do you make poor people feel wealthy when wages are stagnant? You give them cheap loans.

- Chapter One, A Secret Origin Story, p. 14

- These guys lied to infinity. What I learned from that experience was that Wall Street didn't give a shit what it sold.

- Chapter One, A Secret Origin Story, p. 24

- A credit default swap was confusing mainly because it wasn't really a swap at all. It was an insurance policy, typically on a corporate bond, with semiannual premium payments and a fixed term.

- Chapter Two, In the Land Of The Blind, p. 29

- Ever since grade school, when his father had shown him the stock tables at the back of the newspaper and told him that the stock market was a crooked place and never to be trusted, let alone invested in, the subject had fascinated him.

- Chapter Two, In the Land Of The Blind, p. 35

- the more he studied Buffet, the less he thought he could be copied; indeed, the lesson of Buffet was: To succeed in a spectacular fashion you had to be spectacularly unusual.

- Chapter Two, In the Land Of The Blind, p. 35

- The CDO was, in effect, a credit laundering service for the residents of Lower Middle Class America. For Wall Street it was a machine that turned lead into gold.

- Chapter Three, " How Can A Guy Who Can't Speak English Lie?", p. 73

- Incredibly, at this critical juncture in financial history, after which so much changed so quickly, the only constraint in the subprime mortgage market was a shortage of people willing to bet against it.

- Chapter Three, " How Can A Guy Who Can't Speak English Lie?", p. 80

- Here was a strange but true fact: The closer you were to the market, the harder it was to perceive its folly.

- Chapter Three, " How Can A Guy Who Can't Speak English Lie?", p. 91

- Even as late as the summer of 2006, as home prices began to fall, it took a certain kind of person to see the ugly facts and react to them-to discern, in the profile of the beautiful young lady, the face of an old witch.

- Chapter Five, Accidental Capitalists, p. 107

- Why isn't someone smarter than us doing this?

- Chapter Five, Accidental Capitalists, p. 108

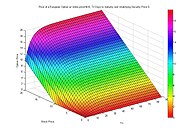

- Looking into it a bit, Jamie found that the model used by Wall Street to price LEAPs, the Black-Scholes option pricing model, made some strange assumptions.

- Chapter Five, Accidental Capitalists, p. 113

- The model used by Wall Street to price trillions of dollar's worth of derivatives thought of the financial world as an orderly, continuous process. But the world was not continuous; it changed discontinuously, and often by accident.

- Chapter Five, Accidental Capitalists, p. 116

- The longer-term the option, the sillier the results generated by the Black-Scholes option pricing model, and the greater the opportunity for people who didn't use it.

- Chapter Five, Accidental Capitalists, p. 122

- He walked around the Las Vegas casino incredulous at the spectacle before him: seven thousand people, all of whom seem delighted with the world as they found it. A society with deep, troubling economic problems had rigged itself to disguise those problems, and the chief beneficiaries of the deceit were its financial middlemen. How could this be?

- Chapter Six, Spider-Man At The Venetian, p. 154

- Each firm held its rope; one by one, they realized that no matter how strongly they pulled, the balloon would eventually lift them off their feet.

- Chapter Nine, A Death Of Interest, p. 209

- The fuses had been lit and could not be extinguished. All that remained was to observe the speed of the spark, and the size of the explosions.

- Chapter Nine, A Death Of Interest, p. 225

- The big Wall Street firms, seemingly so shrewd and self-interested, had somehow become the dumb money. The people who ran them did not understand their own businesses, and their regulators obviously knew even less.

- Chapter Ten, Two Men In A Boat, p. 244

- All that was clear that the profits to be had from smart people making complicated bets overwhelmed anything that could be had from servicing customers, or allocating capital to productive enterprise.

- Epilogue, Everything Is Correlated, p. 258

Boomerang (2011)

[edit]- Spain and France had accumulated debts of more than ten times their annual revenues. Historically, such levels of government indebtedness had led to government default. “Here’s the only way I think things can work out for these countries,” Bass said. “If they start running real budget surpluses. Yeah, and that will happen right after monkeys fly out of your ass.”

- Preface, p. xii

- Yet another hedge fund manager explained Icelandic banking to me this way: you have a dog, and I have a cat. We agree that each is worth a billion dollars. You sell me the dog for a billion, and I sell you the cat for a billion. Now we are no longer pet owners but Icelandic banks, with a billion dollars in new assets.

- Chapter 2, p.17

Flash Boys (2014)

[edit]- The world clings to its old mental picture of the stock market because it’s comforting; because it’s so hard to draw a picture of what has replaced it; and because the few people able to draw it for you have no interest in doing so.

- p. 4

- The best way to manage people, he thought, was to convince them that you were good for their careers. He further believed that the only way to get people to believe that you were good for their careers was actually to be good for their careers.

- p. 26

- "You see, I’m the event. I am the news"

- p. 34

- Why, between the dark pools and the public exchanges, were there nearly sixty different places, most of them in New Jersey, where you could buy any listed stock? Why did the public exchanges fiddle with their own pricing so often—and why did you get paid by one exchange to do exactly the same thing for which another exchange might charge you?

- p. 44

- Someone out there was using the fact that stock market orders arrived at different times at different exchanges to front-run orders from one market to another.

- p. 50

- He now suspected that every human being who knew how high-frequency traders made money was making too much money doing it to stop and explain what was going on.

- p. 55

- The U.S. stock market was now a class system, rooted in speed, of haves and have-nots. The haves paid for nanoseconds; the have-nots had no idea that a nanosecond had value. The haves enjoyed a perfect view of the market; the have-nots never saw the market at all. What had once been the world’s most public, most democratic, financial market had become, in spirit, something like a private viewing of a stolen work of art.

- p. 69

- The orders resting on BATS were typically just the 100-share minimum required for an order to be at the front of any price queue, as their only purpose was to tease information out of investors. The HFT firms posted these tiny orders on BATS—orders to buy or sell 100 shares of basically every stock traded in the U.S. market—not because they actually wanted to buy and sell the stocks but because they wanted to find out what investors wanted to buy and sell before they did it. BATS, unsurprisingly, had been created by high-frequency traders.

- p. 73

- The deep problem with the system was a kind of moral inertia. So long as it served the narrow self-interests of everyone inside it, no one on the inside would ever seek to change it, no matter how corrupt or sinister it became

- p. 88

- The role had been spawned by the widespread belief that traders didn’t know how to talk to computer geeks and that computer geeks did not respond rationally to big, hairy traders hollering at them.

- p. 93

- Reg NMS was intended to create equality of opportunity in the U.S. stock market. Instead it institutionalized a more pernicious inequality. A small class of insiders with the resources to create speed were now allowed to preview the market and trade on what they had seen.

- p. 98

- The entire history of Wall Street was the story of scandals, it now seemed to him, linked together tail to trunk like circus elephants. Every systemic market injustice arose from some loophole in a regulation created to correct some prior injustice.

- p. 101

- The SEC staffer argued that it was unfair that high-frequency traders couldn’t post phony bids and offers on the exchanges to extract information from actual investors without running the risk of having to stand by them.

- p. 105

- "Liquidity" was one of those words Wall Street people threw around when they wanted the conversation to end, and for brains to go dead, and for all questioning to cease.

- p. 108

- Thus the only Goldman Sachs employee arrested by the FBI in the aftermath of a financial crisis Goldman had done so much to fuel was the employee Goldman asked the FBI to arrest.

- p. 148

- "For geniuses, they are really dumb,” she said. “Some of them are really pampered: They can’t even put together a cardboard box. They don’t think you do something. They think you call somebody."

- p. 188, quoting Tara McKee

- It was neither healthy nor good when public stock exchanges introduced order types and speed advantages that high-frequency traders could use to exploit everyone else. This sort of inefficiency didn't vanish the moment it was spotted and acted upon. It was like a broken slot machine in the casino that pays off every time. It would keep paying off until someone said something about it; but no one who played the slot machine had any interest in pointing out that it was broken.

- p. 233

- They traded in the market the way card counters in a casino played blackjack: They played only when they had an edge. That’s why they were able to trade for five years without losing money on a single day.

- p. 263-4

- The relationship of the big Wall Street banks to the high frequency traders, when you think about it, was a bit like the relationship of the entire society to the big Wall Street banks. When things went well, the HFT guys took most of the gains; when things went badly, the HFT guys vanished and the banks took the losses.

- p. 264

- The more money to be made gaming the financial markets, the more people would decide they were put on earth to game the financial markets – and create romantic narratives to explain to themselves why a life spent gaming the financial markets is a purposeful life.

- p. 266

The Fifth Risk (2018)

[edit]- People who had lived without government were more likely to find meaning in it. On the other hand, people who had never experienced a collapsed state were slow to appreciate a state that had not yet collapsed.

- p. 24

- If your ambition is to maximize short-term gain without regard to the long-term cost, you are better off not knowing the cost. If you want to preserve your personal immunity to the hard problems, it's better never to really understand those problems. There is an upside to ignorance, and a downside to knowledge. Knowledge makes life messier. It makes it a bit more difficult for a person who wishes to shrink the world to a worldview.

- p. 77

Quotes about Michael Lewis

[edit]- As was brilliantly documented in Michael Lewis's book Flash Boys, Wall Street makes billions by buying huge quantities of stocks and bonds and then selling them shortly thereafter. The big investment houses and hedge funds have invested hundreds of millions of dollars in super-highspeed computers that detect the slightest price movements, then execute trades in mere fractions of a second. Once the price goes up-sometimes by just a fraction of a penny per share, and after just a few seconds or even less the traders dump the securities. When repeated tens of millions of times, the practice reaps an unbelievably enormous profit for Wall Street.

- Bernie Sanders Our Revolution (2016)